Tyson: Change waiting in wings

Though consumers choose between brands at the grocery store, they don't always choose between companies.

Springdale-based Tyson Foods sells Tastybird and Weaver chicken, Corn King and Wright bacon, and Russer and Wilson ham, among many other branded meats and prepared dishes that are often stocked side by side.

And, after Tyson completes its $8.55 billion acquisition of Chicago-based Hillshire Brands, consumers who choose Ball Park, Sara Lee, Hillshire Farm, Jimmy Dean or State Fair will also be choosing Tyson.

Tyson and Hillshire have brands large and small that compete against one another. While Tyson's acquisition of Hillshire means that some brands could be discontinued, some analysts think there will be little change in what the company offers on store shelves.

"It's more likely that you'll see Tyson want to take the smaller brands, even if they're competing with Tyson's brands, and to really leverage them up and expand them," said Martin Thoma, a principal at Little Rock-based Thoma Thoma, a brand leadership firm, and author of Branding Like the Big Boys. "It works to Tyson's benefit either way."

Hillshire's lesser-known brands include Bryan Foods, Kahn's, Rudy's Farm and Golden Island Jerky.

And Hillshire's larger brands aren't going away anytime soon.

Tyson and Hillshire spokesmen declined to comment for this article, but during the June 9 conference call announcing Tyson's purchase of Hillshire, Tyson CEO Donnie Smith said the company would work to expand Hillshire's brands.

"Brands like Hillshire and Jimmy Dean and Ball Park, you know, they don't become available very often," Smith said. "We're purchasing these assets not for what they are today, but for their potential to create additional value over time."

According to the Tyson investor presentation that accompanied the conference call, Jimmy Dean, Hillshire Farm, Ball Park, State Fair and Aidells all lead in market share in at least one category.

The market share data Tyson used came from IRI, a Chicago-based market research firm.

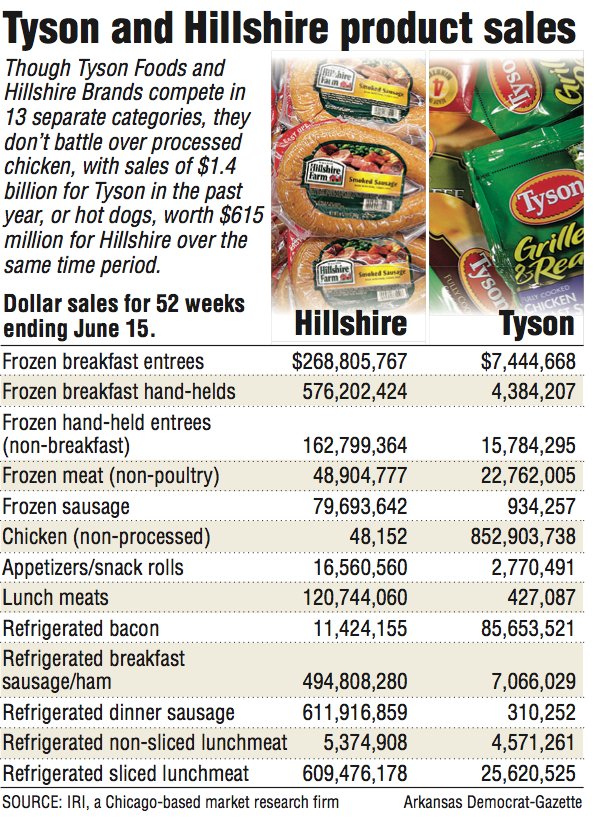

According to additional data from the firm, Hillshire offers products in 36 different product categories as varied as cheesecake and bacon. The company gleans 16 percent of its sales from hot dogs -- more than from any other category -- though dinner sausage and lunch meats aren't far behind.

Hillshire sells hot dogs under the Ball Park, Kahn's, Bryan and Briar Street brand names. Of the company's $3.8 billion in annual sales, $615 million came from hot dogs, according to the IRI data.

The data show Tyson is a more focused company. The company offers products in 22 categories, but processed chicken accounts for 47 percent of sales, followed by nonprocessed chicken, which accounts for 28 percent of sales. Other major product categories include bacon and dinner entrees, and uncooked meats other than poultry.

Tyson sells chicken under Holly Farms, Tastybird, Weaver, Lady Aster and Tyson brand names. Processed and nonprocessed chicken accounted for $2.3 billion of Tyson's $3 billion in annual sales, according to the IRI data.

Thoma said sales numbers aren't the only factor to take into account when determining the value of brands.

"The other way to think about brands is this whole bundle of associations -- feelings that people in general have with a product, good or service," he said. "One of the truisms in marketing science is that people make decisions with their emotions and use reason to justify that."

Brands emotionally resonate with some consumers, but getting the cheapest price by buying a store brand could elicit a stronger emotional response with others.

Karen Post, an author and professional speaker based in Florida who writes and lectures about branding and who has worked with the American Meat Institute, said branding involves two balance sheets -- sales and the good will a brand elicits.

For example, Ball Park is associated with athletes and loved by children, which enhances its reputation, she said.

"These brands in particular have a lot of history and they have local roots," she said. "They are trying to humanize the company and develop a relationship that's about trust and familiarity with the brand."

According to a report from the Food Marketing Institute, an industry group representing food retailers and distributors, consumers are developing stronger preferences for both store brands and brand names. The number of undecided shoppers has sharply decreased since the recession.

Price per pound remains the most important aspect of meat purchasing to consumers, according to the report -- an important factor for store brands. But consumers are becoming more interested in nutrition, preparation knowledge and cooking time, areas where brands can differentiate themselves.

"Food brands are extremely important, because a successful brand really makes the buying choice easy," Post said. "In my experience, when companies buy a portfolio of brands, they keep the strong ones as well as the ones that continue to be relevant."

Tyson was one step closer to acquiring Hillshire on Wednesday. The company made a formal offer totaling nearly $8.1 billion based on the terms of the previously announced acquisition agreement, according to documents filed with the U.S. Securities and Exchange Commission. Tyson has valued the acquisition at $8.55 billion, including the assumption of debt.

The tender offer expires at midnight on Aug. 12, unless the offer is extended. In previous statements, Tyson said it expected the deal to close by Sept. 27, the last day of the company's fiscal year.